Why Market Selection Matters

Picking the right market can make or break your real estate investment. It determines your rental income, appreciation potential, vacancy risk, and long-term ROI. While national trends offer context, local dynamics drive performance. That’s why savvy investors dive deep into market-specific data before making a move.

Key Factors That Define a Top Market

Before listing the best markets, here’s what we looked for:

- Population & Job Growth: Are people and employers moving in?

- Affordability Index: Is the market still accessible for investors?

- Cash Flow Potential: Do rents support positive monthly cash flow?

- Appreciation Trends: Is there upward pressure on home prices?

- Landlord-Friendliness: Does the local legal framework favor owners?

- Inventory Levels: Is housing supply tight, driving demand?

Top U.S. Real Estate Markets for 2025

1. Austin, Texas

- Why It’s Hot: Austin is a tech hub with sustained in-migration and a vibrant economy.

- Median Home Price: ~$450,000

- Average Rent for 3BR SFH: ~$2,700

- Investor Perks: High appreciation, strong rent growth, and landlord-friendly laws.

Ideal For: Buy-and-hold, mid-term rentals (travel nurses, digital nomads), and BRRRR strategies.

2. Tampa, Florida

- Why It’s Hot: Tampa offers a balance of affordability and coastal lifestyle, attracting retirees and remote workers.

- Median Home Price: ~$395,000

- Rental Yield: 6–7%

- Population Growth: +4.2% over the past 3 years

Ideal For: Long-term rentals and vacation rentals with DSCR loan support for income-focused investors.

3. Charlotte, North Carolina

- Why It’s Hot: A fast-growing finance and logistics hub with a rising millennial population.

- Median Home Price: ~$380,000

- Renter Demand: High due to young professionals and hybrid workers.

- Cash Flow Outlook: Strong for SFR and small multifamily homes.

Ideal For: House hacking and HELOC-powered portfolio expansion.

4. Indianapolis, Indiana

- Why It’s Hot: One of the most cash-flow-friendly cities in the Midwest.

- Median Home Price: ~$250,000

- Cap Rates: 7–9% common in C-class neighborhoods.

- Landlord Advantage: Very investor-friendly regulations.

Ideal For: Out-of-state investors using DSCR loans and turnkey providers.

5. Huntsville, Alabama

- Why It’s Hot: A sleeper hit with military presence, NASA employment, and a booming aerospace sector.

- Population Growth: +20% in a decade

- Median Price: ~$270,000

- Rental Stability: Strong, even during economic downturns.

Ideal For: DSCR loan borrowers targeting stable long-term returns with low competition.

6. Boise, Idaho

- Why It’s Hot: Boise has cooled slightly from pandemic highs but remains a top-tier market for mid- to long-term growth.

- Median Home Price: ~$450,000 (down from ~$515,000 peak)

- Migration Trends: Strong from California and Seattle

- Rent Demand: Healthy, especially for mid-tier multifamily.

Ideal For: Repositioning underperforming properties and value-add plays.

7. Columbus, Ohio

- Why It’s Hot: One of the most overlooked stable cash-flow markets.

- Median Home Price: ~$275,000

- Rental Yields: 8–9% on duplexes and quads

- Big Win: Intel’s $20B semiconductor factory is bringing jobs and housing pressure.

Ideal For: Portfolio DSCR loans and repeat BRRRR investors.

Emerging Markets Worth Watching

These cities are not yet in the national spotlight but show promising signs:

- Greenville, SC – Strong job growth, affordable pricing.

- Des Moines, IA – Stable returns and low volatility.

- Chattanooga, TN – Tech investments and logistics hubs.

- Little Rock, AR – High yields for low entry prices.

How to Choose the Right Market for Your Strategy

Every investor has a unique strategy. Here’s how to match market type with your goal:

| Strategy | Best Market Types |

|---|---|

| Cash Flow | Indianapolis, Columbus, Little Rock |

| Appreciation | Austin, Charlotte, Boise |

| Short-Term Rentals | Tampa, Chattanooga, Huntsville |

| BRRRR | Columbus, Indianapolis, Huntsville |

| Equity Recycling (HELOC) | Charlotte, Tampa, Austin |

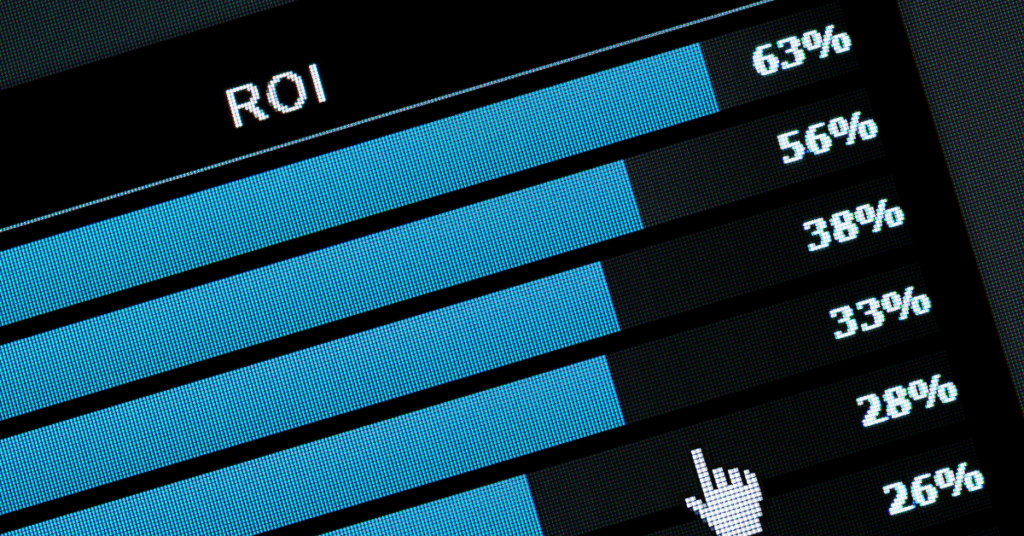

Tip: Use tools like DSCR calculators, rent comps, and ROI estimators before committing to a market. Make sure your financing strategy aligns with market fundamentals.

Final Thoughts

Real estate is hyper-local. While national headlines offer clues, investor success comes down to picking a market where your strategy thrives. Whether you’re looking for high-yield cash flow or long-term appreciation, 2025 presents an exciting landscape—especially if you’re equipped with the right financing tools and a clear investment thesis.

Our advise is based on experience in the mortgage industry and we are dedicated to helping you achieve your goal of owning a home. We may receive compensation from partner banks when you view mortgage rates listed on our website.